In the world of deceit and fraud, Robert Riagah has carved out a notorious niche. His name is synonymous with “wash wash” activities, a term used in Kenya to describe elaborate scams involving counterfeit money and gold. Riagah first came into the public eye in 2019, and since then, his actions have continued to shock and fascinate the nation.

The 2019 Lang’ata Arrest

Riagah’s notoriety began in 2019 when he was arrested alongside seven others in Lang’ata. The group was caught with millions in fake US dollars and 100 kilograms of fake gold. This arrest happened shortly after another group swindled a Dubai-based businessman out of 500 million Kenya shillings in a similar scheme. The connection between these incidents suggested a widespread and organized network of fraudsters operating within Kenya.

The Mysterious Death of Kevin Omwenga

In 2021, Riagah’s name resurfaced in a chilling context. Kevin Omwenga, a young man allegedly involved in the wash wash gang, was found dead under mysterious circumstances. A lady claiming to have dated Omwenga suggested he was shot after a deal went awry. This allegation, coupled with Omwenga’s lavish lifestyle, painted a grim picture of the risks associated with wash wash activities.

Read: Mr. Robert Riagah and Jared Otieno, Exposing the Wash-Wash Syndicate In Kenya

Kevin Omwenga’s Lavish Lifestyle

Omwenga’s life was marked by opulence. He reportedly bought former singer Tanasha Donna her first car, a blue BMW, with the logbook still under his name. Additionally, he kept a safe in his house, once holding at least Ksh 17 million. His wealth and spending habits were extravagant, raising suspicions about the sources of his income.

The Aftermath of Omwenga’s Death

Omwenga’s death shocked the public, leading to widespread speculation and media coverage. His alleged connection to wash wash schemes became a focal point, with many wondering about the extent of his involvement and the possible repercussions for those associated with him.

Riagah’s Continued Activities

Despite the high-profile arrests and Omwenga’s death, Riagah remained active. His name surfaced again in relation to other wash wash incidents, indicating that he had not been deterred by previous legal troubles. This persistence highlighted the challenges law enforcement faced in curbing such fraudulent activities.

The Victim’s Story: The 440,000 Ksh Scam

One of the more detailed accounts of Riagah’s fraudulent activities came from a victim who lost 440,000 Ksh. This victim was initially introduced to the wash wash business by a longtime acquaintance, Samuel Oyugi. The promise of easy money was too tempting to resist.

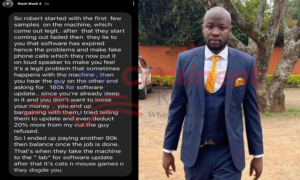

The Money-Minting Machine Scam

The scam revolved around a so-called money-minting machine, purportedly capable of printing large sums of money. The victim was told he could turn Ksh 300,000 into Ksh 3 million. This seemed like a golden opportunity, and he decided to give it a shot.

The Role of Samuel Oyugi and Michael Okongo

Oyugi, along with Michael Okongo, played key roles in the scam. They convinced the victim to rent an apartment and pay for the machine and necessary materials. Riagah was introduced as the owner of the machine, adding an air of legitimacy to the operation.

The Deception Unfolds

Initially, the machine produced some convincing samples. However, the quality soon deteriorated, and the scammers claimed the software had expired. This led to a series of fake phone calls and additional payments, all designed to string the victim along.

The Trip to Sarit Centre

The scammers orchestrated a trip to Sarit Centre for a supposed software upgrade. The victim was asked to follow their car in an Uber, ensuring he wouldn’t be able to track them easily. Once at the location, the scammers vanished, leaving the victim stranded and bewildered.

The Realization and Aftermath

It was only after the scammers disappeared that the victim realized he had been conned. His attempts to contact them were futile, and he soon accepted that his money was gone. The realization that he had lost 440,000 Ksh within a week was a harsh blow.

The Role of Authorities

Despite reporting the scam to the police, the victim received little support. This lack of effective law enforcement response underscored the challenges faced by victims of wash wash schemes and the impunity enjoyed by the perpetrators.

Impact on Public Perception

Incidents like these have a significant impact on public trust. The pervasive nature of wash wash schemes erodes confidence in financial transactions and institutions. Media coverage of such scams fuels public anxiety and skepticism, making it harder for genuine businesses to operate.

Robert Riagah’s story is a stark reminder of the dangers and complexities of wash wash schemes. His repeated involvement in fraudulent activities highlights the need for stronger regulatory measures and more effective law enforcement. As long as such schemes continue to thrive, individuals and businesses alike remain at risk.

FAQs

What is the wash wash scam? The wash wash scam involves convincing victims to invest in counterfeit money schemes, often promising high returns through fake money-minting machines or counterfeit currency.

How can people protect themselves from such scams? People can protect themselves by being cautious of deals that seem too good to be true, verifying the legitimacy of financial opportunities, and avoiding transactions with unknown parties.

What are the legal consequences of being involved in wash wash? Involvement in wash wash schemes can lead to severe legal consequences, including arrests, fines, and imprisonment for fraud and counterfeit activities.

Are there any ongoing investigations related to these incidents? Ongoing investigations are often challenging due to the sophisticated nature of these scams and the involvement of multiple parties. However, law enforcement agencies continue to pursue leads and crack down on such activities.

How do these scams impact the economy? Wash wash scams can have a detrimental impact on the economy by undermining trust in financial institutions, deterring investment, and causing significant financial losses to individuals and businesses.